Property Tax & Utility Accounts

Property Taxes

Sample tax notice

The tax notices are sent at the end of May and are due December 31st of the year in which the notice is issued. Any amount unpaid by December 31st will be carried forward to the new year and will be subject to a 1.5% penalty on the first of every month thereafter until paid.

Early Tax payment discounts (on municipal portion only):

8% discount for any tax amounts paid before June 30th

5% discount for any tax amounts paid from July 1st to September 30th.

A breakdown of the dates and discounted amounts can be found on your Tax Notice in the lower left side.

Payment Options

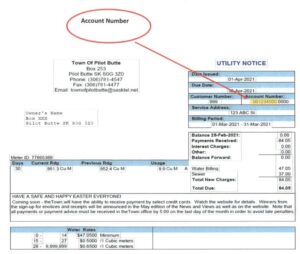

You may pay any of these bills in person at the Town office by cash, cheque, debit or Option Pay credit card https://pilotbutte.ca/local-government/optionpay/ , or you may pay on line as you would any other on-line bill by choosing either the “Town of Pilot Butte”, or “Pilot Butte, Town of” as the payee. If your bank requires a 7- digit number please add 0’s to the front of the number until the desired number is reached.

The Town does not offer a monthly Tax Installment Payment Program (TIPP), however you may make online payments regularly/at your convenience to accumulate a credit in your tax account in preparation for the next Tax Notice.

Online payments should be made in advance of the due date, as it can take 3-5 business days for the Town to receive the payment.

Receipts for tax payments will be sent by mail, or you may choose to receive these receipts by email.

Tax Rates

Property Class |

Average Taxable Assessment |

Mill Rate |

Mill Rate Factor |

Base Tax |

Total Municipal Tax |

| Residential | 325,000 | 5.31 | 1.037 | $1,789.61 | |

| Commercial & Industrial | 375,000 | 5.31 | 1.4373 | $2,862.03 | |

| Agricultural | 40,000 | 5.31 | 2.2 | $467.28 |

Utilities

Utilities are billed in the first day or two (depending on weekends) after the month in which the usage occurred and are due at the end of the billing month. Interest will be charged at the rate of 1.5% per month on unpaid balances.

You have the option of receiving utility, tax and assessment notices by e-mail. Here is the current link for this service: https://pilotbutte.ca/local-government/municipal-services/#1.

The town does not send out utility receipts when payments are received online or by cheque.

We encourage new residents to call into the Town Office when they move to town. Water service is rarely turned off. We will transfer the billing into your name when we receive confirmation of the title change from ISC using the date of official title transfer.