Property Taxes

The property tax year is from January 1st – December 31st of the current year. Property tax notices are sent at the end of May and are due December 31st of the year in which the notice is issued. Any amount unpaid by December 31st will be carried forward to the new year and will be subject to a 1.5% penalty on the first of every month thereafter until paid.

2025 Early Tax payment discounts (on municipal portion only)

- 8% discount on payments made by June 30th

- 5% discount on payments made July 1-September 30

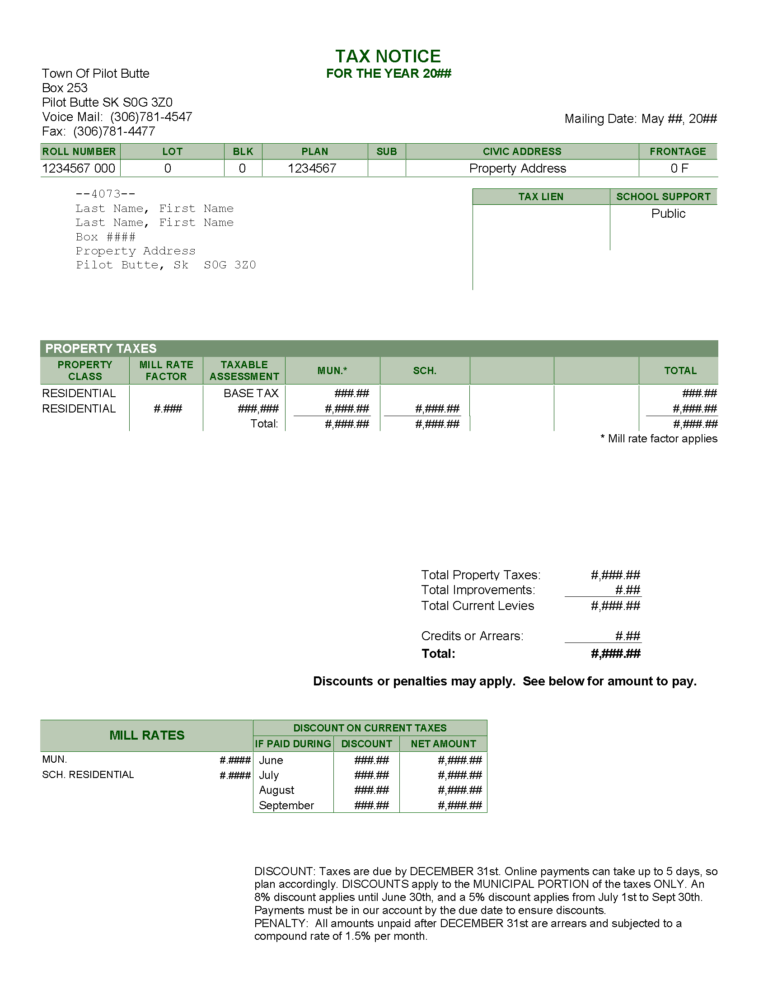

A breakdown of the dates and discounted amounts can be found on your Tax Notice in the lower left side.

Sample tax notice above

Tax Payment Options

Payments can be made at the town office during regular business hours at 222 Diamond Place by cash, cheque, debit, or through OptionPay (for more information on OptionPay click here), or through your online banking as a bill payment:

- Add Payee

- Search Pilot Butte, Town of

- Choose Tax or Utility depending on which you want to make payments to

- Follow the prompts on your internet banking

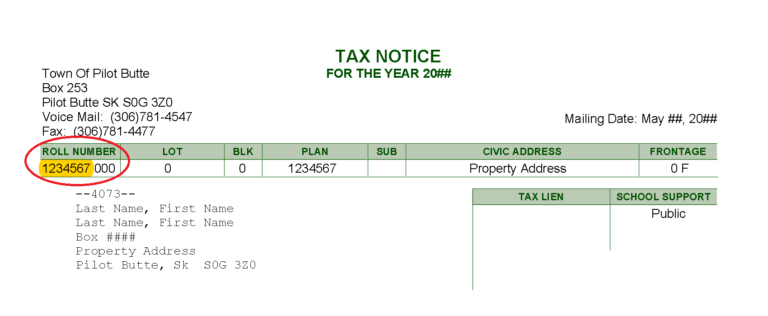

For Taxes use the Roll Number noted on the top left of your Tax Notice using the first 7 digits (if your Roll Number is less than 7 digits and your bank requires a full 7 digits you may put 0’s in front) exclude the following 3 digits.

Online payments should be made in advance of the due date, as it can take 3-5 business days for the Town to receive and process the payment.

Receipts for tax payments will be sent by your preferred delivery method; mail or e-notice.

The Town does not offer a monthly Tax Installment Payment Program (TIPP), however you may make online payments regularly/at your convenience to accumulate a credit in your tax account in preparation for the next Tax Notice.

Mill Rates

Town Council sets the Municipal Mill Rate and the Province of Saskatchewan sets the education property tax mill rates.

2025 Municipal Mill Rates

| Property Class | Mill Rate | Mill Rate Factor | Base Tax |

| Residential | 5.31 | 1.037 | $200.00 |

| Commercial & Industrial | 5.31 | 1.4373 | $200.00 |

| Agricultural | 5.31 | 2.2 | $200.00 |

2025 Education Mill Rates

| Property Class | Mill Rate |

| Residential | 4.27 |

| Commercial & Industrial | 6.37 |

| Agricultural | 1.07 |

Property taxes are calculated using the following equation:

Assessed Value x 0.80 x Mill Rates X Mill Rate Factor / 1000 + Base Tax = Municipal Portion of Taxes

For example of the 2025 Municipal portion of taxes if a residential property is assessed at $300,000:

$300,000 x .80 x 5.31 x 1.037 / 1000 + $200.00 = $1521.55

Assessed Value x 0.80 x Education Mill Rates) / 1000 = Education Portion of Taxes

For example of the 2025 Education portion of taxes if a residential property is assessed at $300,000:

$300,000 x .80 x 4.27 / 1000 = $1024.80

The Municipal portion + Education portion of taxes = the total tax levy.

Tax Certificates

Tax Certificates are available upon request for properties located within the Town of Pilot Butte.

Information provided includes:

- Roll number

- Legal Address

- Civic Address

- Current Year Assessment

- Most recent tax levy

- Property Taxes owing or credit balance on account

- Local Improvements

- Outstanding Utilities

- Liens (if any)

- Base tax

Acquiring a Tax Certificate

If you require a tax certificate, they are available through written request submitted to our office via email or by fax. The fee for a tax certificate is $25 for each tax property. Once processed, the certificate will be faxed or emailed. The original paper copy will be sent via mail, once payment is received.

Included in your request should be the legal and/or civic address of the property along with a copy of your firm’s cheque for payment amount made out to the Town of Pilot Butte in the amount of $25.00.

Please fax your written requests to 306-781-4477 or email to reception@pilotbutte.ca. If you have any other questions or concerns, please do not hesitate to contact our office at 306-781-4547 option 1.